5 Steps to Serving More (and better quality) Customers

It’s the end of 2015 Q2 today. That means half the year is gone – aarrrhh! Are you on track in your business? Is revenue meeting projections? Are you achieving your profitability targets? If you are a small business owner or solopreneur, are you paying yourself what you are worth?

If you can’t answer a big fat YES to those questions, then you have work to do. Right?

Don’t worry, you’re not alone. There are loads of businesses like yours, not quite hitting their business goals at the end of Q2. I have to confess, in one of my businesses, I haven’t hit my Q2 targets either, so I’m practising what I’m about to preach. I also know that with lots of focus, the next 6 months can end on a high. Let’s end 2015 with a HUGE flourish within our businesses.

People do business with people – That’s a fact! And we prefer to do business with people we like. After all, we spend a lot of time in our businesses. So, here’s my 5 step guide to ensure you attract the right people (customers) to your business; people whom you like and trust, and who are right for your business to serve.

Step 1 – Identify Your Most Profitable and Enjoyable Customers

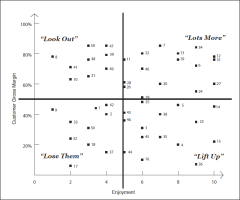

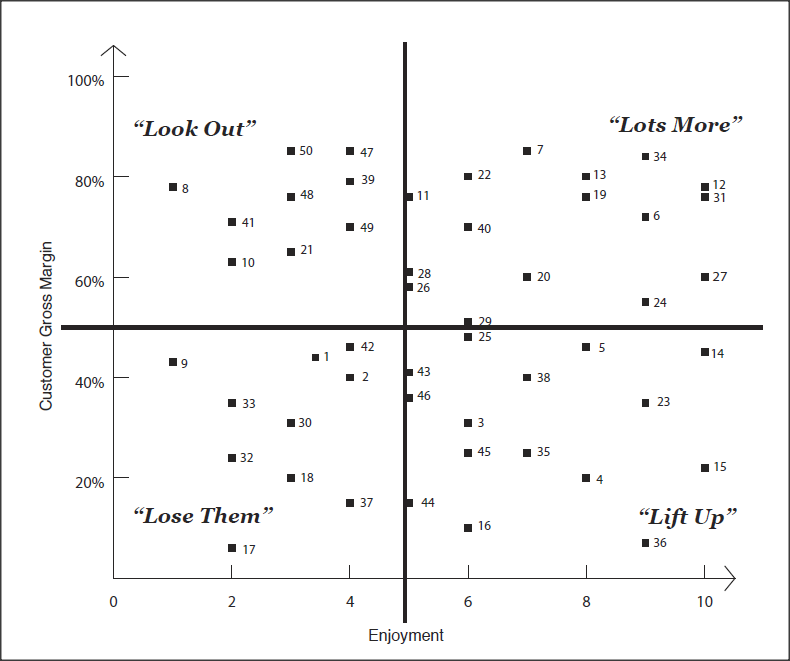

How? It’s easy. I’ve created a simple tool called the L? Customer Profitability Quadrant which does the work for you. It puts your existing customers into 4 quadrants according to how profitable and enjoyable they are.

The 4 quadrants, are:

- “Lots More” – highly profitable and enjoyable customers.

- “Lift Up” – highly enjoyable but lower profitability customers.

- “Look Out” – low enjoyment and highly profitable customers.

- “Lose Them” – low enjoyment and low profitability customers.

Here’s what each quadrant looks like after you’ve done the exercise.

From the descriptions, it’s plain which quadrant you want more of in your business – the “Lots More” customers, of course.

Yet, there are issues to be considered with the other quadrants.

The “Look Out” customers pose a threat to your business because if they leave you, your profitability may be affected (if you have plenty of customers in this group, your profitability will be seriously affected).

The “Lift Up” customers need addressing too as you and your team may be over delivering to them as they are enjoyable people to serve, but that is not time well spent at present as they aren’t profitable enough for you.

The “Lose Them” customers are generally a drain on your business and are often price shoppers, so do you really want them?

Click here to download my free E-book that shows you how to create your own L? Customer Profitability Quadrant. I promise it’s really easy to work out.

Step 2 – Define the Common Features of the Customers in Your “Lots More” Quadrant

In all situations I find that when an analysis is done on the types of customers that make up the “Lots More” quadrant, there are common features. There will often be a grouping of industries that they are in, or geographic locations, or you may be selling similar products or services to them.

Do the work to define what the common characteristics are, as you will be able to use this information to target more potential customers like these ones. Don’t try and be everything to everybody. Identify your niche and focus on it.

Step 3 – Evaluate the Key Needs, Wants and Desires of Your “Lots More” Customers

Become really clear on what it is your “Lots More” customers need, want and desire. This is important, as you will only be successful in selling more to them or other customers like them if you truly understand those drivers.

Step 4 – Articulate Your Value Proposition

Do you really know what your value proposition is for your “Lots More” customers? Please spend the time working it out. How are you different? What enables you to serve those customers perfectly so that they return time and again to buy from your business, and hopefully be cheerleaders for your business.

Step 5 – Laser Planning the Next 6 Months

Armed with all the information in steps 1-4, it’s time to create a business/marketing plan for the rest of the year.

In summary, your plan will include the following:

- Strategies to reconnect with your existing “Lots More” Customers, checking in on them and their businesses or lives, and reminding them of your value proposition, products and services.

- Strategies to identify and market your business to potential customers who are have the same profile as those in your “Lots More“ quadrant. If you are good at serving a particular type of customer, go and find more people just like them.

- A ‘sort out’ plan to address the issues with your “Look Out” customers. They are highly profitable to your business, so you don’t really want to lose them. Work out why you aren’t enjoying working with them. Resolve the issues and build bridges. Turn them into “Lots More” Customers too.

- A ‘sort out’ plan to address the issues with your “Lift Up” customers. You enjoy working with them, but they are not profitable enough for your business. Do you really know what their needs, wants and desires are? How can you better serve them so they buy more profitably from you and also become “Lots More” customers?

- A ‘good-bye’ plan to exit the “Lose Them” customers from your business. They are not suited to the products/service you offer, so you are better to facilitate them being served by another business, and then you can focus on your “Lots More” customers.

That’s it. It’s time to do the work. Follow steps 1-5 and watch your revenue and profitability soar by the end of Q4 2015. I’m excited. I hope you are too.

ACTION: I’d love to hear how business is going for you as at the end of Q2. How about sharing your situation below? If your business is going well, tell us what you’re doing. If you need a renewed focus, then email me. Perhaps a 30 mins free Business Growth Strategy Skype call might be just what you need to get ‘back on the straight and narrow’.

Could some guidance from me be helpful to you? If so, please arrange a free 30 mins Skype strategy meeting with me. Here’s my calendar to book a meeting. I’d love to support you in some way to gain ‘seductive clarity’ in any aspect of your business or life.